ACCOUNTING FOR SPECIAL TRANSACTIONS

This course provides the students comprehensive discussion on inter transactions between home office and branch and reflected in the financial statements. Students are expected to prepare the necessary journal entries to record the above transactions and presentation in the entity’s financial statements. The course discusses the requirements of the financial reporting standards pertaining to construction contracts, consignment arrangements, customer-financing, service contracts, franchising and special revenue-producing transactions.

Strategic Cost Management

This course is

designed to acquaint students with the role of accounting in the management

team by providing and assisting in the analysis , interpretation, and

forecasting of business organizations. It covers the discussion of the

foundation of management accounting; its expanding role, organizational structure,

and professional ethics for management accountants; design of management

accounting systems (e.g., responsibility accounting system), evaluating the

impact of changes in business structure, functions and appropriateness of

management accounting techniques and methods; basic interpretation and use of

financial statements; performance measurement for planning and control such as

marginal, absorption, and opportunity costing, cost behavior, cost volume

profit analysis; quantitative techniques and methods for planning and control.

This course also deals with the application and techniques focusing on segment

reporting, profitability analysis and decentralization, information for

decision making purposes (short term and long term) and nonfinancial indicators

such as productivity per employee or per service unit; decision making

affecting short run operations; pricing of goods and services and environmental

cost accounting.

Integrated Accounting Audit - Cost Accounting

This course covers the concepts and principles in advanced financial accounting and reporting and the application of these accounting concepts

including techniques and methodology to problems likely to be encountered in practice. It includes problems involving accounting for special

transactions and their effects and presentation in the financial statements including among others: accounting for partnerships, corporate

liquidation, joint arrangements, revenue recognition, home office and branch/principal and agency transactions, business combinations and

consolidations, foreign currency transactions and translations, not for profit organizations, including government accounting and cost accounting.

Accounting for Government and Non-Profit Organization

This course is

designed to orient the students to accounting and reporting in the government,

not-for-profit organizations, insurance, banks and other related industries.

Topics discussed are concepts and transactions related with government

budgeting, accounting and auditing; accounting and reporting for not-for profit

organizations (NPOs) such as hospitals, colleges and universities, voluntary,

health and welfare organizations (VHWO), and other NPOs. This course also

includes basic concepts related with insurance companies, both life and

non-life, banks, and service concession arrangement. This course is also

designed to distinguish between profit and non-profit organizations.

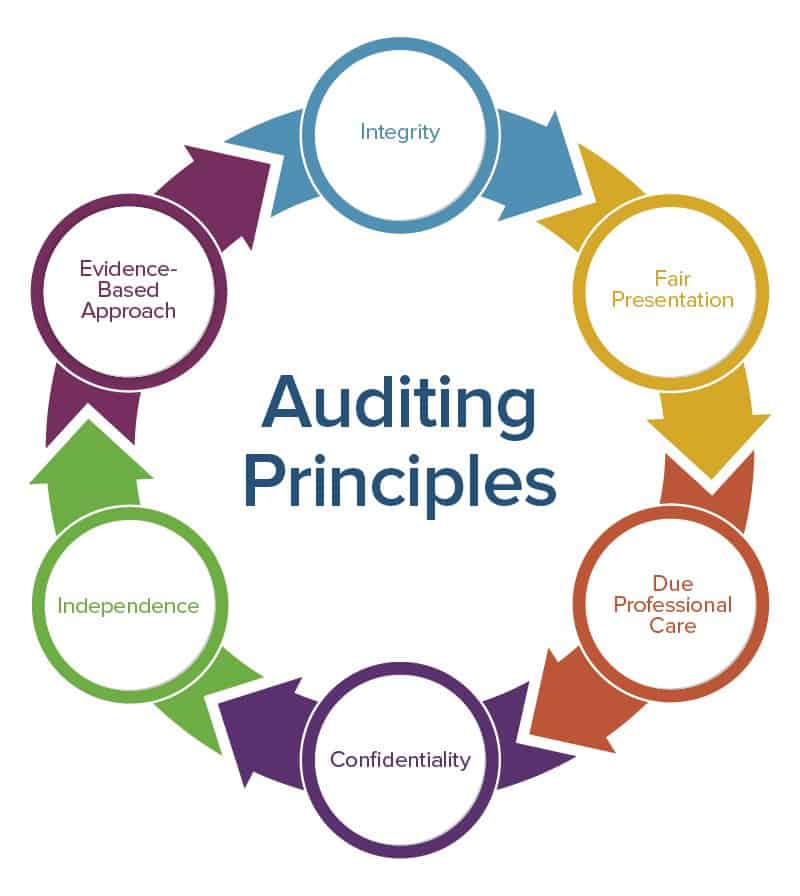

Audit and Assurance: Concepts and Applications 1

This course covers the understanding and application of auditing principles, standards and concepts which will be used to described and perform test of controls and substantive analytical procedures

related to the following transaction cycles. Mainly the procedures will include both test of

control and substantive procedures related to audit of cash; receivables; inventories; property, plant and equipment; investment property; intangible assets and related accounts.

Strategic Cost Management - BSA41

This course is designed to acquaint students with the role of accounting in the management team by providing and assisting in the analysis , interpretation, and forecasting of business

organizations. It covers the discussion of the foundation of management accounting; its expanding role, organizational structure, and professional ethics for management accountants;

design of management accounting systems (e.g., responsibility accounting system), evaluating the impact of changes in business structure, functions and appropriateness of management

accounting techniques and methods; basic interpretation and use of financial statements; performance measurement for planning and control such as marginal, absorption, and

opportunity costing, cost behavior, cost volume profit analysis; quantitative techniques and methods for planning and control. This course also deals with the application and techniques

focusing on segment reporting, profitability analysis and decentralization, information for decision making purposes (short term and long term) and nonfinancial indicators such as

productivity per employee or per service unit; decision making affecting short run operations; pricing of goods and services and environmental cost accounting

UPDATE IN FINANCIAL REPORTING STANDARDS

Financial reporting frameworks and standards continuously evolve to ensure relevance and faithful representation of financial information presented in an entity’s financial statements. Amendments, revisions, and promulgation of new financial reporting standards are necessary to encompass and address the changes in the business environment due to innovative business practices and emerging business models. This course aims to update the learners on the current issues on financial reporting. Recently released financial reporting frameworks and standards, including application guidance and interpretations of the authoritative bodies and regulatory agencies are explored in this course.

Auditing and Assurance Principles

This course is designed to provide students with the conceptual knowledge and understanding of the fundamental theory of auditing and assurance services, and the philosophy underlying audits with emphasis on external auditing as performed by independent Certified Public Accountants and the management of public accounting practice.

The course covers Generally Accepted Auditing Standards

specifically, Philippine Standards on Auditing (PSA), the Philippine

Accountancy Act of 2004, internal and external auditing, internal controls,

manual records, audit objectives, audit techniques, audit programs and

procedures, and audit reports and ethical standards affecting the accountancy

profession are also taken up.

Knowledge Management BPA 3B

The module “Knowledge

Management” introduces basic concepts and ideas on knowledge acquisition,

creation and externalization in modern organization. The main aim of the module is to enable students to

acquire a critical understanding of knowledge as a driver of organization

inimitable strategic capabilities. This module addresses different aspect of

knowledge management: knowledge taxonomies, intellectual assets evaluation,

SECI model and its application, knowledge driven value creation, cross-cultural

issues in KM. In discussing these issues, the students acquire deeper understanding of knowledge phenomenon; develop

their analytical skills for diagnostic of organization intellectual ability as

well as managerial skills for knowledge based strategy implementation.